Computing on Bitcoin #57

September 19, 2025 - Week 38

Welcome to this week’s edition of Computing on Bitcoin News, your go-to roundup for developments shaping Bitcoin as a programmable, secure, and trustless platform.

We’re here to keep you updated on the momentum behind Bitcoin’s transformation.

Let’s get started.

Fairgate has published WISCH, a new protocol for efficient data signing. By generating correlated signatures, WISCH cuts on-chain costs by at least 5× compared to Winternitz and 10× compared to Lamport and GC Wire labels, while maintaining strong UC-based security proofs.

fairgate.io/publications

🔗

WISCH: Efficient Data Signing via Correlated Signatures

The protocol is built on a clean separation between two components:

· On-chain verification core – designed so that costs depend only on the number of revealed items, not on the size of the entire message space.

· Off-chain preparation – where computational work takes place before verification, keeping blockchain operations efficient.

Two new posts in Bitlayer’s “Bitlayer 101” series introduce YBTC, a third-generation representative BTC built on the BitVM Bridge. YBTC replaces human intermediaries with an autonomous BitVM smart contract. Designed to be multi-chain by default, YBTC lets Bitcoin holders put their BTC to work across DeFi ecosystems while relying on cryptographic proofs and fraud-proof verification rather than custodians.

blog.bitlayer.org

🔗

Bitlayer 101 (1): What is YBTC

The world of DeFi already has representative BTC assets like WBTC and tBTC. We categorize YBTC as the third generation, setting a new standard for security and utility thanks to BitVM technology.

Unlike other assets, YBTC maintains a natural and strict 1:1 peg with BTC. This means you don’t have to worry about de-pegging risk.

blog.bitlayer.org

🔗

Bitlayer 101 (2): What Makes YBTC Standout?

In the first chapter of our “Bitlayer 101” series, we introduced you to YBTC: a new, yield-bearing representative BTC that brings your Bitcoin’s utility to multiple chains. We briefly touched upon its foundation—the BitVM Bridge—as the source of its security. Now, let’s dive deeper and explore what truly makes YBTC’s security model a generational leap forward.

BitVMX continues expanding its open source stack with three core components -Transaction Monitor, Bitcoin Coordinator, and Bitcoin Indexer- designed for modular, scalable, and persistent interaction with the Bitcoin network across real-time monitoring, transaction orchestration, and blockchain indexing.

bitvmx.org/knowledge

🔗

BitVMX's Open Source Journey Continues: Bitcoin Monitoring, Coordination and Indexing components now available

These libraries have matured alongside our protocol infrastructure and are now available for public use under the MIT license. They include:

· BitVMX Transaction Monitor – real-time tracking and news generation for transaction confirmations

· Bitcoin Coordinator – orchestrates transaction dispatching,monitoring, and CPFP/RBF-based speedups

·Bitcoin Indexer – blockchain indexer that stores block and tx data for analysis and monitoring

A new panel video from Bitcoin 2025 digs into the architecture of BitVM: tracing its evolution from BitVM1 to BitVM3, explaining how cheaper disputes are enabled, and exploring its use in bridges, ZKVMs, and rollups to scale Bitcoin while preserving its consensus integrity

Behind the Scenes of BitVM’s Architecture

youtube.com/@TheBitcoinConference

Dive into the intricacies of BitVM architecture in this panel from Bitcoin 2025, where experts discuss how BitVM enables arbitrary computations on Bitcoin without altering its consensus. Learn about its evolution from BitVM1's binary search games to BitVM3's optimizations for cheaper disputes. The conversation covers applications like Bitcoin bridges, rollups, and ZKVMs for enhanced scalability and privacy. Discover why BitVM is a game-changer for Bitcoin L2s, allowing trustless verification of off-chain executions.

Speakers: Sagun Garg - Bank Julius Baer, Liam Eagen - Alpen Labs, Stephen Duan - GOAT Network, Janusz

New workshop in Buenos Aires: Input Output, Fairgate Labs and TxPipe are hosting a developer-focused session on Sept 25 exploring BitVMX, BitVM2, garbled-circuit protocols like FLEX, and interoperability models such as TOOP. A technical deep dive into the future of computing and bridging on Bitcoin.

Join us on September 25 for a deep dive into new frontiers in Bitcoin computing: from @BitVMX and BitVM2 to Garbled Circuits and interoperability protocols.https://t.co/B40eeWzCLX

— Fairgate (@FairGateLabs) September 15, 2025

A great opportunity for developers and researchers to explore new models of interoperable…

An article discusses Cardinal, a Bitcoin–Cardano bridge that uses MuSig2 and BitVMX to enable secure, programmable interaction between the two ecosystems.

goat.network/blog

🔗

Why Do We Need Bitcoin L2s?

The biggest appeal of the Bitcoin mainnet is its security. But that security assumption depends largely on the economic incentive that Bitcoin miners get.

With Bitcoin halving events making mining rewards increasingly scarce, those incentives are at risk, with miners now only able to earn a sliver of transaction revenue.

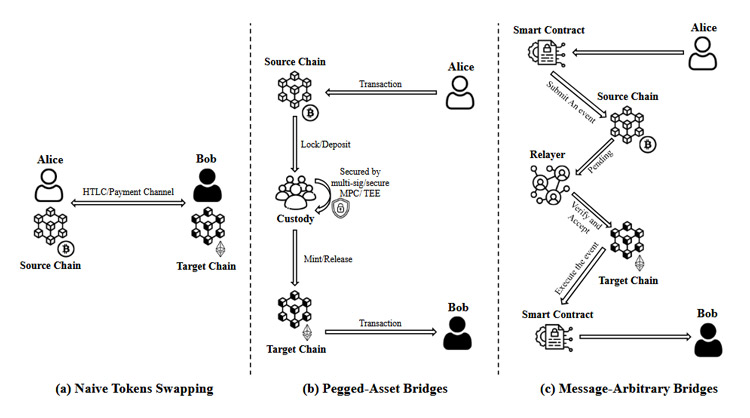

A new paper, Bitcoin Cross-Chain Bridge: A Taxonomy and Its Promise in Artificial Intelligence of Things, surveys existing bridge designs and highlights emerging innovations like BitVM and recursive sidechains. The work categorizes trade-offs in trust, latency, and capital efficiency, while also exploring how Bitcoin bridges could support AIoT applications.

arxiv.org

🔗

Bitcoin Cross-Chain Bridge: A Taxonomy and Its Promise in Artificial Intelligence of Things

Bitcoin’s limited scripting capabilities and lack of native interoperability mechanisms have constrained its integration into the broader blockchain ecosystem, especially decentralized finance (DeFi) and multi-chain applications.

This paper presents a comprehensive taxonomy of Bitcoin cross-chain bridge protocols, systematically analyzing their trust assumptions, performance characteristics, and applicability to the Artificial Intelligence of Things (AIoT) scenarios.

Bitlayer has migrated to Chainlink CCIP as its cross-chain standard, paving the way for YBTC, minted via the trust-minimized BitVM Bridge, to go multichain.

blog.bitlayer.org

🔗

Bitlayer Successfully Migrates to Chainlink CCIP As Its Canonical Cross-Chain Infrastructure to Power YBTC

Currently, YBTC.B—powered by Bitlayer—is live on multiple EVM-compatible blockchain networks including Ethereum, BSC, Avalanche, and Plume Network via CCIP, enabling users to access YBTC.B-based products and tap into novel Bitcoin-based yield opportunities across the multi-chain ecosystem.

A recent article highlights Hemi’s hBitVM system, which combines Bitcoin’s security with Ethereum’s programmability through a dual-consensus ZK rollup design. Built on BitVM concepts, hBitVM introduces a Bitcoin “tunnel” enabling light clients, ZK proofs for Ethereum state validation, and decentralized bridging.

ainvest.com/news

🔗

Hemi Merges Bitcoin's Security with Ethereum's Power in Blockchain Breakthrough

Hemi is nearing the final stages of preparation for its Token Generation Event (TGE), with multiple updates highlighting the progress of its network and tokenomics. The Hemi team has confirmed that the final tokenomics framework is now complete and undergoing internal review. While the exact release date remains pending final approval, the team anticipates a public announcement shortly thereafter. This transparency underscores the project’s commitment to community engagement and clear communication.

BTCfi is gaining momentum, with BitVM and new infrastructure enabling yield on Bitcoin. An early-stage market today, it could mirror Ethereum’s DeFi boom as bridges, lending, and trading mature.

medium.com/quantum-economics

🔗

Prepare Yourself For The Coming BTCfi Tsunami

Staking provides bitcoin denominated returns from blockchains and staking networks that use BTC as collateral for validation. Staking BTC is often pitched as having high security with locking directly on bitcoin chain. It’s a new idea, with little traction, in part, due to the modest ~1% yield offered today. However, yields can be boosted when coupled with token rewards for longer duration placements, or for holding non-bitcoin protocol tokens.

That’s it for this week’s Computing on Bitcoin News.

As innovation around BTC-native programmability and financial tooling accelerates, we’ll continue to bring you the highlights.

See you next Friday with more stories from the edge!

The Fairgate Team